A new industry forecast from Bloomberg warns that data centers will devour roughly 70% of global memory chip production in 2026. The projection points to AI infrastructure as the primary culprit and predicts a supply crunch that could spike prices and create shortages across PCs, smartphones, gaming hardware, and consumer electronics.

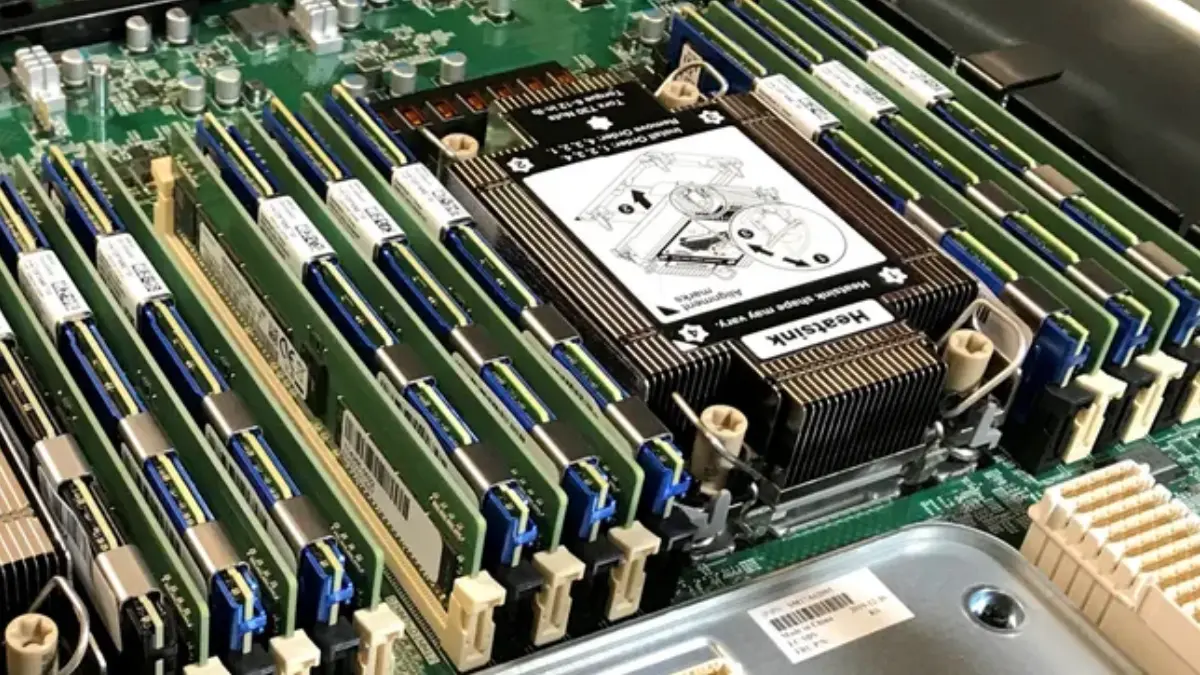

The spike in data center demand stems from multiple simultaneous pressures. Hyperscalers are racing to build out AI training and inference infrastructure, stuffing servers with GPUs and specialized accelerators that each require massive memory footprints. At the same time, a traditional enterprise server refresh cycle is happening in parallel, not instead of the AI buildout.

The memory squeeze centers on DRAM and particularly High Bandwidth Memory (HBM), the stacked memory used alongside AI accelerators. HBM consumes significantly more manufacturing capacity per bit than conventional DRAM. When data centers shift toward HBM-heavy AI servers, they crowd out production capacity for everything else even if total wafer output stays flat.

Global DRAM production is dominated by just three companies: SK hynix, Samsung, and Micron. When hyperscalers sign massive supply agreements with these manufacturers, they can outbid smaller buyers and lock in long-term contracts. That leaves spot market availability thin and prices volatile for PC makers, phone manufacturers, and individual consumers shopping for RAM kits.

The forecast represents a sharp increase from current levels. Data centers consuming 70% of memory output would mark a dramatic concentration of supply into a single category of buyer, fundamentally reshaping how memory gets allocated across the entire electronics industry.

Consumer RAM prices are already climbing. DDR5 kits that sold for under $100 in recent years now command several hundred dollars in some markets. PC builders report sticker shock at retailers as memory costs balloon. The crunch extends beyond gaming rigs—laptops, flagship smartphones, and other devices that rely on DRAM could see price increases or downgraded configurations as manufacturers adjust to constrained supply.

The bottleneck sits at the chip level, not finished products. Data centers don’t necessarily buy consumer DIMM sticks, but they consume the underlying DRAM dies that populate all memory modules. Since every device category competes for the same upstream manufacturing capacity, a surge in data center demand ripples across the entire supply chain.

The infrastructure cost nobody talks about

Beyond component shortages, data centers place massive demands on local electricity grids and water supplies for cooling. Some regions offer discounted utility rates to attract large operators, raising questions about whether infrastructure upgrade costs get socialized across other ratepayers while hyperscalers lock in favorable terms.

Memory markets have historically run in boom-and-bust cycles. Demand spikes produce shortages and price explosions. Overinvestment creates gluts and crashes. The AI infrastructure wave looks different from past booms because it concentrates purchasing power among a small number of extremely large buyers with deep pockets and urgent timelines.