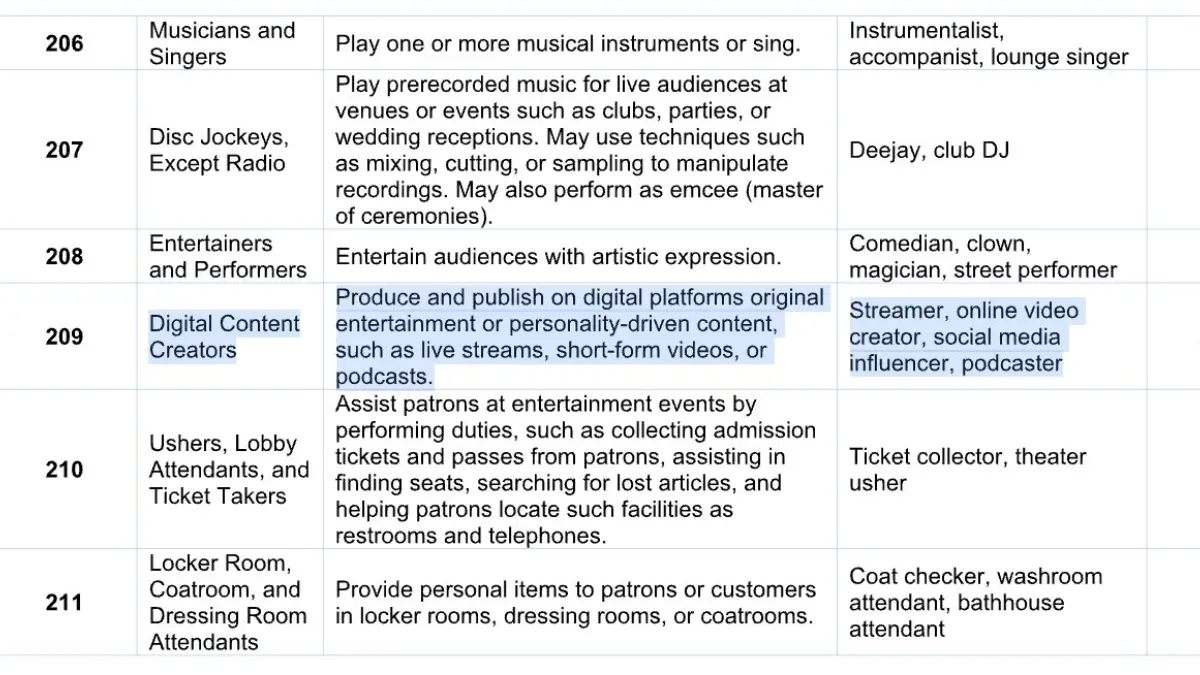

The IRS just added digital content creators to the list of workers who can claim the new “No Tax on Tips” benefit. Starting now, streamers can exclude up to $25,000 in qualifying tips from their federal income taxes each year.

The catch? Only actual tips count. That means voluntary donations from viewers. Subscriptions, bits, cheers, ad revenue, and sponsorship deals don’t qualify. For most successful streamers, that’s where the bulk of their money comes from.

There’s another problem. The tax break only works if platforms like Twitch and YouTube start reporting tips separately on tax forms. Right now, they don’t. Everything gets lumped together on 1099 forms, making it nearly impossible for creators to prove which payments were tips.

The benefit starts disappearing once you make more than $150,000 per year ($300,000 for married couples). For every $1,000 over that limit, you lose $100 of the tip exclusion. A single streamer making $160,000 would only get to exclude $24,000 instead of the full $25,000.

This only covers federal income tax. Creators still have to pay self-employment tax on all their earnings, including tips. State taxes might still apply too, depending on where you live.

The whole thing expires after 2028 unless Congress extends it. The IRS has to publish an official list of eligible occupations by October 2, 2025, which will include digital content creators.

For smaller streamers who get meaningful donations and have modest overall income, this could mean real tax savings. But without changes to how platforms report payments, most creators won’t be able to use it at all.