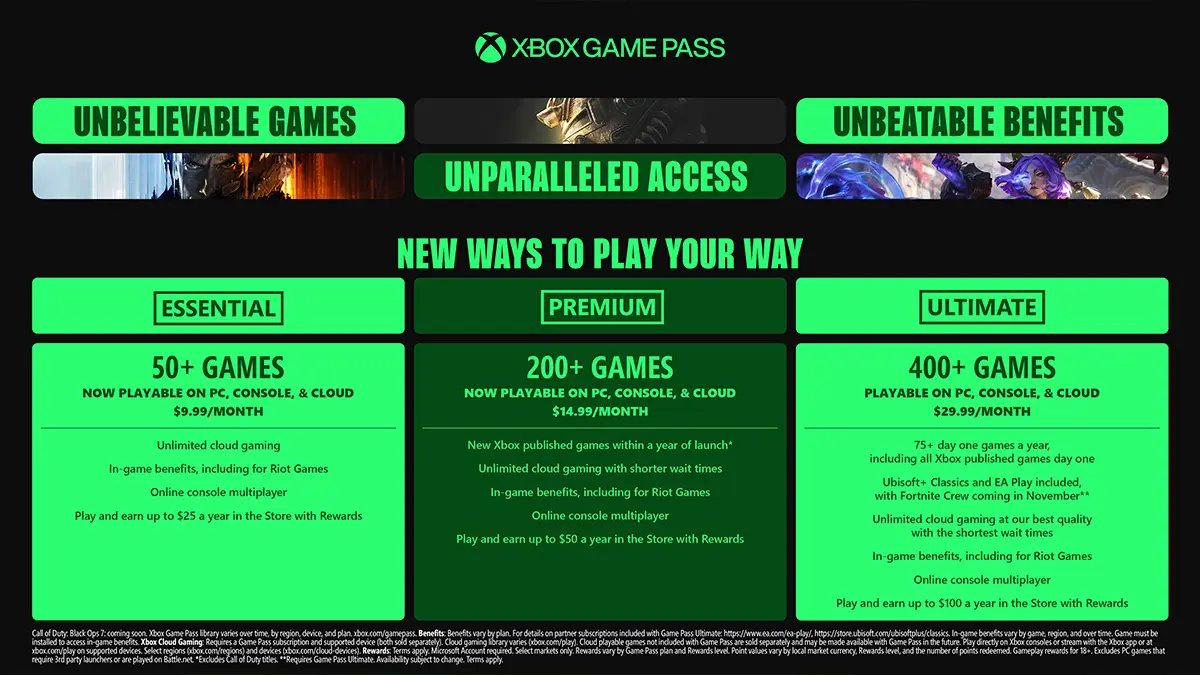

In October 2025, Xbox Game Pass was hit with yet another price hike, its second in 15 months. Though the move sparked backlash massive enough to crash the Game Pass cancellation page, the service isn’t exactly hurting right now.

On the contrary, it hit record subscriber numbers this year, estimated at over 35 million. And as Xbox hardware sales continue to sink, Game Pass has quietly become the heart of Microsoft’s gaming business.

These days, Game Pass is a publishing platform, a marketing vehicle, and for some studios, a kind of patron. By reshaping how games are played and how they make money, it’s also changing how they’re made—though not always intentionally.

How an Xbox Game Pass deal actually works

The path to releasing a game on Game Pass usually starts by joining the ID@Xbox program as an indie developer or by partnering with Microsoft as a publisher through a standard Microsoft Store developer account.

For smaller devs, Game Pass negotiations don’t take place until there’s something for them to show. In August 2023, Microsoft standardized indie submissions with an ID@Xbox pitch portal. Among other things, the platform allows indie devs to apply for Game Pass publishing.

Sometime after the initial pitch is approved by the Xbox portfolio team, the actual publishing negotiations take place. Microsoft Gaming CEO Phil Spencer has long been open about Game Pass deals being “all over the place” because developer circumstances vary.

From what I’ve managed to dig up, Spencer’s assessment is broadly true, with one provision: Microsoft does have a generic Game Pass publishing contract, it’s just that it doesn’t always use it.

Inside the negotiation room

“There is certainly a standard agreement,” one developer who previously published on Game Pass and agreed to speak under the condition of anonymity tells me. They posit that a boilerplate agreement of this sort is to be expected from “a service which has hundreds of games at any one time.”

While not willing to divulge numbers, they tell me that financially, the standard Game Pass agreement “is in line with any other similar deal we’ve done.” Moreover, it’s not a take-it-or-leave-it offer—they describe the Xbox team as open to negotiations and “very reasonable” when discussing tailor-made terms.

The entire process of pitching a title and negotiating a Game Pass deal takes between three and six months, but this timeframe can still vary “massively,” as per the same source.

For high-profile IPs that come with a built-in audience, it stands to reason that negotiations could drag on for even longer. However, I was unable to confirm this because it turns out that big publishers aren’t too eager to discuss their business dealings, even when asked for general info and promised anonymity, go figure.

The structure of a Game Pass deal

A typical Game Pass publishing deal has two financial components: a flat licensing fee and recurring payments based on player engagement. The fee may be paid upfront, upon release, or as a partial advance, with the rest coming after launch.

In some cases, Microsoft may even chip in for development, which would usually be done via the ID@Xbox program. But even if it doesn’t help fund the game directly, the guarantee of income from its flat fee can still help tremendously.

Such indirect benefits were enjoyed by Everspace 2, which got an entire extra year in the oven thanks to Microsoft’s funds. Developer Rockfish described this as a huge luxury, saying everyone got a better game thanks to its Xbox Game Pass deal.

Publisher No More Robots shared a similar story about Spirittea. The curious cross of Stardew Valley and Spirited Away was initially targeting a 2022 release but ended up launching with more content and polish a year later because of its Game Pass deal.

The economics of exposure

Apart from guaranteed money, Game Pass is also appealing to smaller developers because it guarantees exposure.

As one-man studio Jump Over the Age, AKA Gareth Damian Martin, explained in a March 2024 Edge interview, his weird dystopian RPG blew up largely because of Microsoft’s subscribers. “They all say things like, ‘I don’t play these kinds of games, but I tried it because it was on Game Pass, and I loved it,’ and that was massive for Citizen Sleeper,” he said.

Citizen Sleeper was a day-one Game Pass release in 2022, and its 2025 sequel followed suit. Both are still available to XGP subscribers, with Martin saying he has no intention of pulling them from the service.

One of the biggest hits of 2025, Clair Obscur: Expedition 33, also launched day-one on Game Pass because its developer wanted to maximize its outreach, with Guillaume Broche saying as much in an August 2025 interview.

The deal with Microsoft also led to Expedition 33 being promoted alongside heavy-hitters such as Fable and Gears of War during the latest Xbox Games Showcase. Publisher Kepler Interactive cited this as another big factor contributing to the game’s massive success.

How Game Pass eats its own sales

Exposure is nice and all, but at the end of the day, Game Pass doesn’t exactly help with sales. Activision is on record as stating subscription services “severely cannibalize buy-to-play sales,” especially when it comes to day-one releases that Microsoft’s service is known for.

This doesn’t kill the subscription model, but it does mean the licensing fee has to at least offset the missed sell-through, if not exceed it. It often does so for indies and AA games, but big-budget projects are a different beast. It’s thus no surprise that most day-one Game Pass releases are either smaller-scale titles or something made by an Xbox-owned studio.

Microsoft’s been trying to alleviate this issue by giving subscribers courtesy discounts—typically around 20% off—on titles that are about to leave Game Pass. These deals have been around since the service launched in 2017 but there’s no hard data on how big of a difference they make.

That lack of evidence suggests the leaving-soon discounts aren’t a big sales driver. If they were, Microsoft would likely be eager to point that out.

Why your favorite games are starting to feel different

Recent market research from Newzoo suggests Game Pass isn’t really changing how games are played. However, it’s definitely influencing how some of them are made.

The most obvious examples are the kind mentioned above: games like Everspace 2 and Spirittea getting more development time because of Microsoft money. The less obvious but potentially larger effect has to do with how games are designed.

The original streaming disruptor, Netflix, reshaped the entire entertainment landscape, changing what kind of content gets approved and bankrolled. Data-driven commissioning, binge-first storytelling and release, and shorter seasons are just some of the effects it had on the industry.

Game Pass is a 10 year younger service, and its first-mover advantage did not last nearly as long as Netflix’s. So, its influence on content design isn’t as big (yet), though it can still be felt. Fancensus’ industry data suggests subscription services have lengthened video game lifecycles, extending their profit windows and pushing more studios toward committing to longer post-launch support in order to maintain player interest and chase those engagement payouts.

However, the change has been slow. According to a 2024 survey by Game Developer Collective, 80% of developers maintain platforms like Game Pass did not influence their game design. And though more than one-third of responders expect to bring their offerings to subscription catalogs in the future, only 13% said this business model had some impact on their creative process.

Developers who do acknowledge Game Pass’s influence are focusing on earlier hooks, making the first 30 or so minutes of a game more engaging than ever. They’re also rethinking how to deliver early rewards and build gameplay loops that keep players coming back. Sometimes these goals overlap; other times, they stand alone, depending on the genre.

The risks of the Game Pass model

There’s no denying that the upsides of Game Pass are big, but so are its trade-offs.

Bigger budget, bigger sacrifice

Sales cannibalization is an issue that grows proportionally with budgets. On the triple-A end of the spectrum, Bloomberg reports Microsoft gave up $300 million in Call of Duty: Black Ops 6 sales by putting it on Game Pass day one.

You could make half of a modern Call of Duty entry or 15 Gen 10 Pokémon games with that kind of money. Give $300 million to RGG and they’ll give you 15 Yakuza games with just as many Sujimon mini-games, and—unlike Pokémon—those will even be good. No matter how you cut it, that’s a lot of cheddar to give up.

A different kind of uncertainty

While Game Pass deals are said to be fairly friendly, they’re still opaque. Even the boilerplate agreement terms are private, making it hard for studios to benchmark whether they are getting a fair deal from the outset.

Moreover, deals that focus on engagement rates can make planning no less of a headache than it already was. It’s just that you’re replacing one risk variable (sales) with another (licensing fees).

That uncertainty is part of why you hear ex-execs warning subscriptions can undervalue creators if the balance isn’t right. Some industry veterans like the former Bethesda publishing boss Pete Hines believe Game Pass is undercutting developers and pushing them to sell themselves short.

After several years of mass layoffs, there’s also a growing belief among developers that Game Pass is “the elephant in the room,” arguing its model pressures premium sales and rewards only certain monetization styles. Others disagree, but the sentiment is out there, and it affects how studios think about risk.

Sustainability concerns

This brings us to the next big issue: sustainability. Though Microsoft insists Game Pass is profitable, two price hikes in 15 months suggest it isn’t profitable enough for its liking. At the same time, growth is slowing down—a lot.

After averaging more than 5 million subscribers annually for its first 4.5 years, the service lost enough steam for Microsoft to stop reporting on this metric in January 2022, when it boasted about hitting 25 million users. Nearly four years later, Game Pass is estimated to be sitting at around 35 million subscribers.

If Microsoft isn’t satisfied with profitability but can’t find more subscribers fast enough, it’ll either keep hiking prices or start slashing developer licensing fees. Maybe both.

In an ideal world, developers could just fish for better deals elsewhere if they find themselves dissatisfied with Xbox terms. But bear in mind Microsoft spends $1 billion per year on Game Pass. No rival can match that.

No one’s even trying to mimic the day-one Game Pass releases due to the crazy amounts of money this strategy requires. If you’re a dev, the invisible hand of the market won’t conjure up some healthy competition to save you if Microsoft ever alters the deal here.

The Netflix slop effect

In the long run, subscription catalogs reward “easy-to-sample” design the way Netflix rewards second-screen TV: fast hooks, simple beats, and familiar loops that don’t punish divided attention.

Over time, that can tilt greenlights and push projects toward safer, more predictable experiences—not because devs want to phone it in, but because the almighty algorithm does.

Where the Game Pass experiment goes next

For all its perks and pitfalls, Xbox Game Pass has built a new layer of the industry that sits somewhere between publishing, marketing, and funding. Microsoft insists it doesn’t want to replace game sales, but Game Pass has already rerouted how a significant amount of money moves through the industry, changing who gets paid, when, and how much.

The jury’s still out on its long-term sustainability, but the model is already successful and profitable enough to influence what kinds of games get made. Whether that’s a good thing is another question.

That’s the secret economy behind Xbox Game Pass: a system where visibility and guaranteed income can make or break studios, acting as both a lifeline for underperforming games and a launchpad for indies. For everyone else, however, they’re still a big question mark.

Moreover, even if profitable, Game Pass still runs on Microsoft’s gigantic wallet that no other gaming company can match. If that balance ever shifts, if subscriber growth slows or licensing budgets tighten, the ripple effects will reach far beyond Xbox.